When: 22 – 24 April

Where: Dawlitz Hotel, Rabat, Morocco

Authors: Hubert Foy, David Hess, Pablo José Pérez Cañavate

Key points

- The 4th Africa Nuclear Business Platform (AFNBP) 2025 in Rabat was a truly welcoming and important conference that highlighted which African countries are making significant progress in nuclear energy development, and just as importantly, which established nuclear countries/ companies are committed to helping them. Topics such as financing and the importance of regional approaches dominated the agenda.

- Seventeen African countries are moving ahead with nuclear energy plans to tackle electricity shortages, boost water desalination, and power industrial heating. South Africa is already up and running, while Egypt is getting closer to flipping the switch on its first nuclear plant. While the African continent is currently behind its peers when it comes to nuclear development, it has the unique opportunity to learn from the experience of others and leapfrog them in terms of introducing innovation and leveraging good practices.

- France’s nuclear sector sent a strong contingent and announced a programme to bring young Moroccan engineers to France, where they could support the anticipated French nuclear expansion, before returning to Morocco in time for that country’s expected nuclear energy programme. From South Korea, KHNP was present and boasted an impressive stand. The KHNP CEO expressed commitment towards African nuclear energy development and signed an MoU with Nigeria

- Apparently missing from the event were anyone from the US State Department and any major US vendors. Rosatom/Russia may have been present, but did not have a stand. The same appeared to be true for Chinese vendors. All in all, only a subsection of the global nuclear industry turned up to express their support in what is Africa’s premier nuclear energy event. This seems to reflect recent global developments

- Africa is aiming high, targeting 15,000 MW of nuclear capacity by 2035, which could open up a $105 billion investment window. While Russia, China, and France are currently leading the partnerships, there’s a growing call for more diverse, fair, and empowering tech and financing models.

What Happened

The conference ran from 22 -24 April 2025. There were two private workshops held on 22 April for African participants that the author did not attend. These were hosted by GIFEN and Excel Services.

The conference sessions covered various issues and allowed all the speakers to highlight progress in their own countries and discuss national strategies for nuclear energy. Many of these sessions were moderated by Don Hoffman of Excel Services, which was a platinum sponsor of the event, and who did a great job of keeping the conversation active and insightful. A handful of expected guests were unable to attend the conference due to visa issues. Uganda was entirely unrepresented.

The topic of nuclear project financing came up a number of times across multiple sessions. The lack of viable financing options was acknowledged as an inhibitor to African nuclear development, which also effectively narrowed the number of viable partner countries that African countries could turn to as full technology partners. Other topics discussed included regional approaches, capacity building, regulations, and the workforce.

During the morning first break on 23 April, senior figures from KHNP and Nigeria took to the centre stage to sign an MoU on nuclear cooperation. This followed a very rousing speech that was provided by the KHNP CEO, Whang Joo-ho, in an early session. The KHNP stands out clearly with digital representations of their SMR technology on display.

The workforce challenge is real and global in scope, applying not just to Africa but also to the established nuclear countries, which are now planning substantial newbuild programmes. In a session on 24 April, a member of French utility EDF made an active pitch to Moroccan engineering graduates. The offer is to bring them over to France, train them up on various roles, then give them the option to return to Morocco in time for that country’s nuclear construction

Another impressive contingent was sent by Caelus, which is developing artificial intelligence software for the nuclear industry. At the end of the last day, Caelus and DeepGEO (which is pursuing the development of multinational repositories for spent nuclear fuel) also signed an MoU.

Background

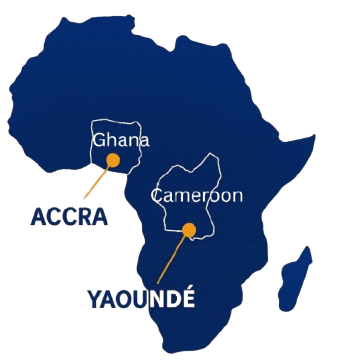

Africa’s nuclear story isn’t new — it kicked off in 1984 with South Africa’s Koeberg plant. But momentum slowed over the years due to financial hurdles and security worries. Fast forward to the 2000s, and a new wave of ambition took shape: Nigeria and Ghana launched plans, and Egypt started building its El Dabaa plant in 2022.

Today, the AU’s Agenda 2063 puts energy security front and center, but nuclear still makes up just 3% of Africa’s electricity. Past barriers like weak grids, financing gaps, and public skepticism still linger. Russia’s Rosatom has been a dominant force with Build-Own-Operate models, while the U.S. and France are pushing to make their mark through SMR technology.

Africa’s future with nuclear hinges on getting the balance right — ensuring energy sovereignty while staying aligned with global safety and security standards. There’s also a pressing need for innovative technologies and business models that will accelerate nuclear energy development on the continent. There’s a real need for African leadership, through bodies like the African Commission on Nuclear Energy (AFCONE), to step up to ensure nuclear development truly serves a sustainable future.